Guest Author: Ron Meade

An open house can make or break a property sale. A successful open house isn't a matter of luck but a result of carefully planned and executed strategies. In this article, we'll delve into open house strategies that really work, guiding you step by step to turn potential buyers into signed contracts.

Stage One: Preparation

Home Staging: Your First Step

A well-staged home speaks volumes to prospective buyers. Depersonalize the property, allowing potential buyers to envision their lives in the space. Sprucing up the property – a fresh coat of paint, tidying up, and placing fresh flowers – can make a world of difference.

Timing is Everything

The right timing sets the stage for a bustling open house. Opt for weekends, preferably Sunday afternoons, as it's the most convenient time for many. Factor in weather and holiday seasons, avoiding times when potential buyers may be occupied.

Spreading the Word

Marketing your open house can range from traditional methods like flyers and newspaper ads to digital strategies, including social media and email marketing. Don't underestimate the power of virtual tours, which are particularly useful for distant buyers or in times of social restrictions.

Stage Two: Open House Day

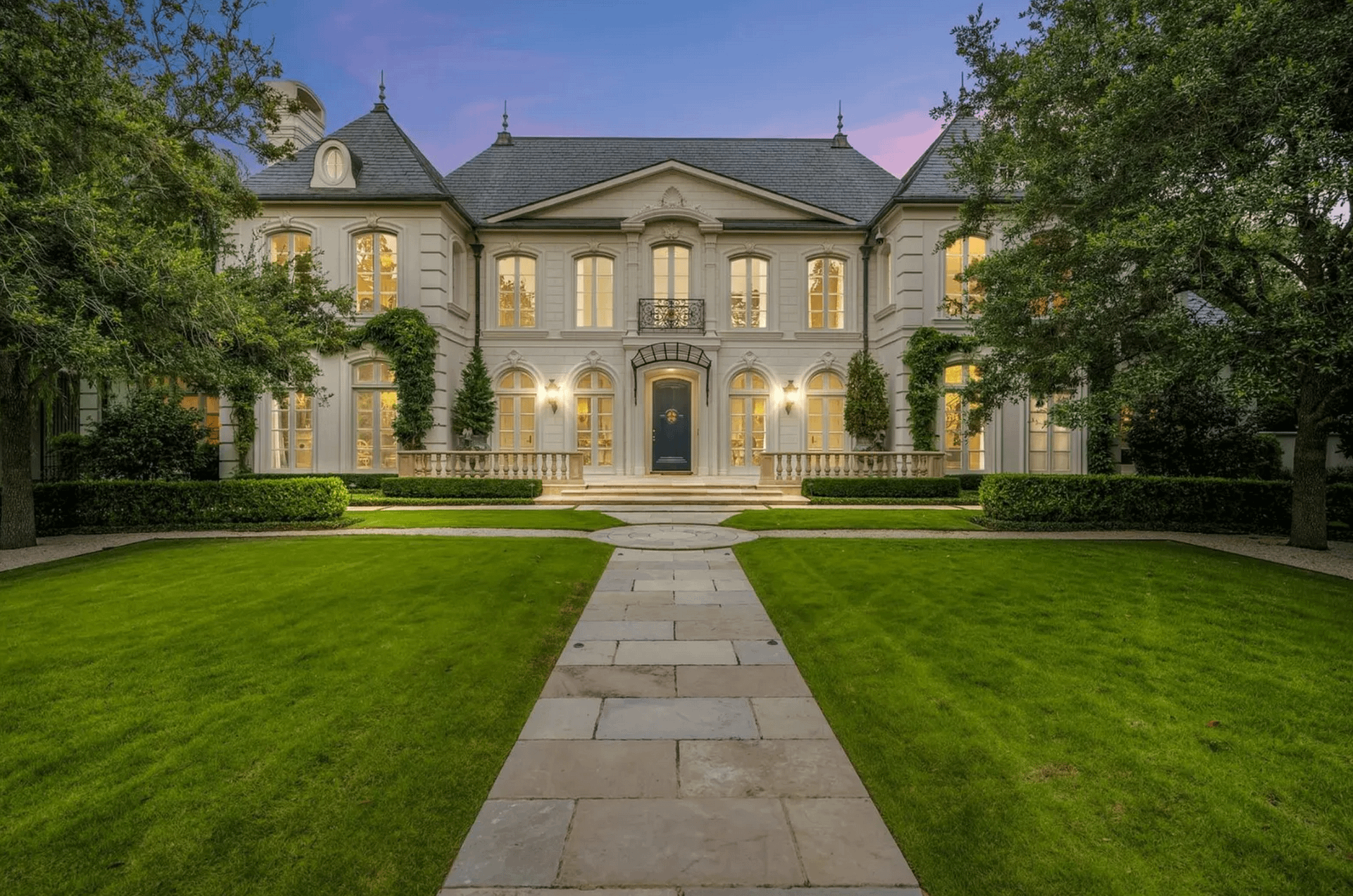

Making a Positive First Impression

As with any encounter, first impressions matter. Prioritize curb appeal; a trimmed lawn, a clean entryway, and a welcoming sign can set the right tone. Moreover, create a hospitable atmosphere indoors with soft music and refreshments.

Engaging with Potential Buyers

At this stage, you should use a realtor. Their expertise allows them to confidently answer queries about the property, neighborhood, and local real estate market. They also illustrate the property's potential, demonstrating how each room can serve multiple functions.

Recording Visitor Information

Maintaining a record of your attendees is crucial. It aids in post-open house follow-ups and evaluating the event's success. A simple registration system at the entrance can help capture visitor information effectively.

Stage Three: Post-Open House

The Follow-Up

Post-open house, let a realtor help with follow-ups. They have experience in striking a balance between maintaining interest without coming across as pushy. Their skill can be vital in converting a potential buyer into an actual buyer.

Open House Evaluation

Take the time to analyze attendee feedback. It offers valuable insights into the property's strengths and the areas needing improvement. This information is essential for refining your future open house strategies.

Stage Four: Tailoring Strategies to Property Types

Showcasing Luxury Properties

Luxury properties need a unique approach. Highlighting high-end features, upscale neighborhood amenities, and exclusive benefits can entice the right buyer.

Presenting Small or Challenging Properties

For smaller properties, focus on functionality and potential. Demonstrate how a compact space can be utilized efficiently or how a challenging property can be turned into an asset with a little creativity.

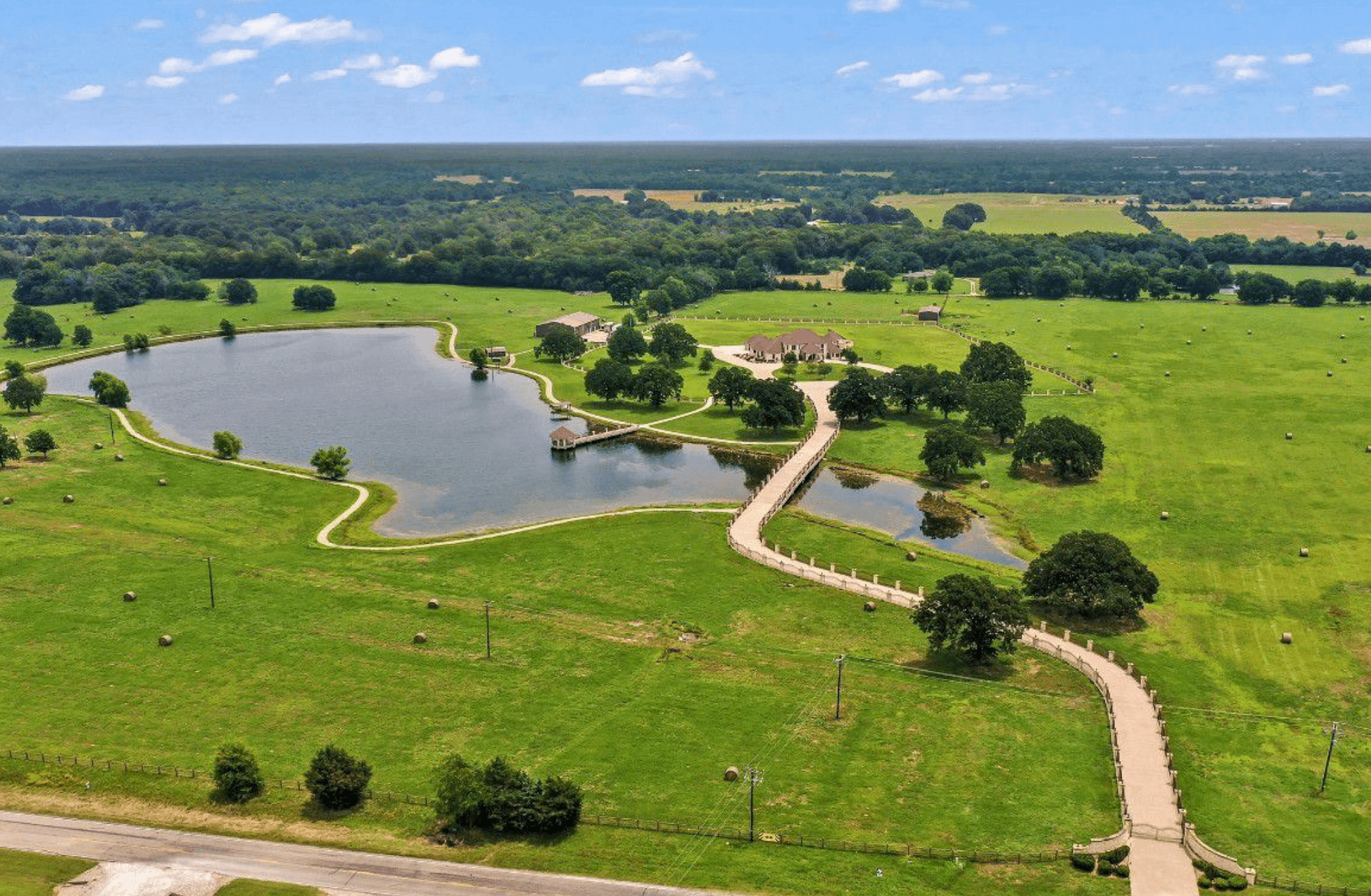

Investment Properties: A Different Ball Game

Showcasing investment properties requires a shift in strategy. Highlighting potential ROI, rental income, or property appreciation can catch the attention of savvy investors.

Moving to a New Residence

An open house is just one part of your journey. Once you've implemented your open house strategies and made the sale, there's a whole new adventure: moving to a new residence.

In particular, moving from California to Texas represents an exciting new chapter. The transition involves a change in scenery and a shift in lifestyle, culture, and even weather. Considering all these factors, it's crucial to plan and organize your move well in advance.

Start by creating a comprehensive checklist. This list should include tasks like hiring a reputable interstate moving company, changing your address in all relevant documents, and setting up utilities at your new Texas home. Don’t forget to research Texas' local customs, climate, and community resources, which can be quite different from California.

Embrace this change as an exciting opportunity to explore a new area, meet new people, and create new memories. Yes, moving can be challenging, but with the right planning and a positive outlook, you're well on your way to making your new house in Texas your new home.

Partner with the Right Professional

Choosing the right real estate professional is pivotal in this journey. The right realtor can provide invaluable insights into effective open house strategies and assist you in tailoring them to your specific property. Their expertise and local market knowledge can guide you in attracting the right buyers, answering their queries effectively, and securing the sale. As such, take your time to find the realtor who matches your needs - someone experienced, personable, and genuinely invested in achieving your selling objectives.

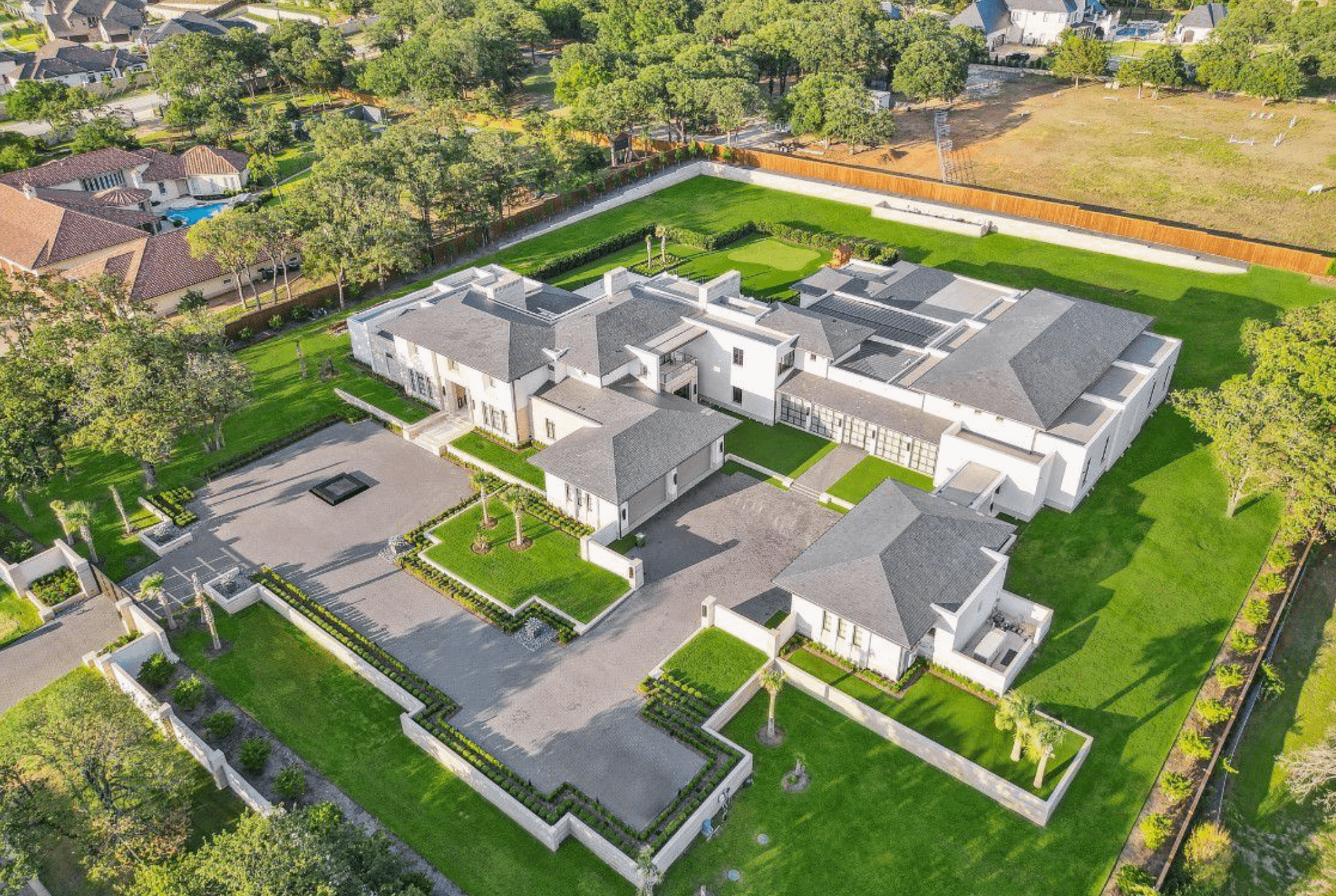

Leveraging Technology – Virtual Tours and Drones

As technology evolves, so do open house strategies. Virtual tours are an excellent example of this. They allow potential buyers to explore the property at their convenience, giving them a 360-degree view of the space. This strategy can be particularly beneficial for buyers who may not be able to attend the open house physically.

In addition to virtual tours, drone photography has become an exciting new tool in the real estate industry. High-quality drone footage can provide potential buyers with unique views of the property, highlighting its layout, surrounding landscape, and proximity to local amenities. It's a fresh, engaging way to generate interest and stand out in a crowded market.

Creating Stories – The Emotional Connection

Storytelling can be a powerful open house strategy. Every home has a story to tell, and the key is to make potential buyers a part of it. You can achieve this through personal anecdotes about the property, neighborhood, or town. Perhaps the garden was the setting for family barbecues, or maybe the local park hosts a beloved annual event. Sharing these stories can foster an emotional connection between the buyers and the property, enhancing its appeal. Remember, people don't just buy homes – they buy into lifestyles and communities.

Conclusion – Open House Strategies as a Gateway to Success

To conclude, open house strategies are a powerful tool in the real estate market. With careful preparation, thoughtful presentation, and strategic follow-up, these strategies can transform an ordinary open house into a compelling event that resonates with potential buyers. Remember, each property is unique, and so should your approach. With the right strategy and the right realtor, success is within reach.

Bio:

Ron Meade is a respected real estate expert with over a decade years of experience where he worked with professional service providers like Mod Movers Monterey. Now a full-time writer, Ron leverages his practical knowledge and insights to create engaging, informative content. His expertise extends from local California markets to national real estate trends. In his spare time, Ron enjoys outdoor adventures with his golden retriever, Bentley.

Photo used:

https://www.freepik.com/free-vector/people-going-housewarming-party-flat-characters-open-house-open-inspection-property-welcome-your-new-home-real-estate-service-concept-pinkish-coral-blue-vector-isolated-illustration_11668264.htm#query=open%20house&position=23&from_view=search&track=ais

.jpg)

.jpg)

.jpg)

.jpg)

![15 Safest Cities in Texas [2023 Data]](https://uphomes.com/storage/blogposts/June2023/v9jOQnVYx4iwy0qRduG4.webp)