SPECIAL: This is a repost from one of my other blogs: www.SanAntonioRealEstate.blog

Introduction

My regular readers know that we keep this blog pretty much to real estate and posts that are unique one time articles. We are breaking all norms with this first post of a 3 part series - our very first trilogy if you will. And there is good reason for that.

I have known the author for more than a decade. Tim and I were introduced by a mutual acquaintance at a time of need for our family. I had an aging parent struggling with many medical expenses and high out of pocket costs. We were in need of a solution.

The first meeting was by phone and during that time Tim took note of all the current doctors and agreed to research an insurance plan that keep the medical providers intact. A couple days later, he came out to the house and presented the options. If memory serves me, his systems searched something near 500 plan options.

He found a plan that met all the criteria and that was my first introduction to a Medicare Advantage plan. It was an outstanding option and proved to be the solution we needed. Since then, Tim has helped me personally with the right plan, which we review every year and I have literally referred dozens of friends and associates to his office knowing that they are in good hands.

So, I hope you enjoy this series and if you have a need, please give Tim a call. In the interest of full disclosure, Tim is not paying for us to publish this article nor do we receive any sort of commission or other form of payment. Call this a public service from us and I hope it will help you or someone you know.

Al Cannistra

Our Guest Author today: Tim Allen, BA, MM, CSA

“What Kind of Medicare Plan Might Fit Your Unique Needs?”

Client Tales – Part One of a Three-Part Series

Welcome to Client Tales, where you will read stories about Medicare beneficiaries, what plans worked best for each one and why. With Annual Enrollment right around the corner, the goal of this series is for you to be able to know which of the various options out there might best fit your unique needs and to help you avoid costly mistakes. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all your options.

Client Tale #1

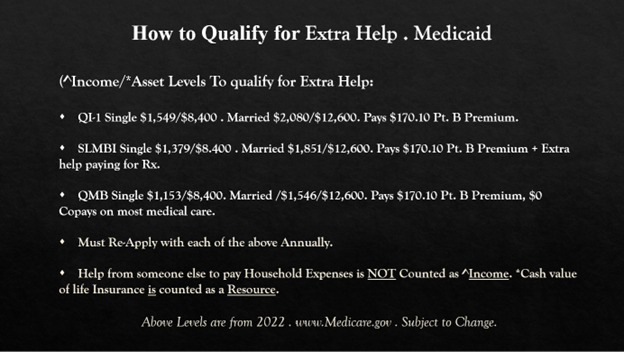

Rosita and Carl are married with a monthly income of $2,000 and resources of $12,500.

Resources include checking, savings, investments, and cash value of life insurance. They do not include residence, car, your personal belongings. Rosita and Carl are on Medicare. They didn’t know it, but they could apply for Extra Help as eligible Qualifying Individuals and did not have to pay the $170.10 Part B Premium.

We helped them get Part B and the Extra Help as Qualifying Individuals so they could receive Part B at no cost. They have the full benefit of Medicare and saving a lot of money on medical and drug copays as well!

Check out this chart to see if you might qualify:

If you are eligible, you may receive Extra Help in the Medicare Savings Program which may pay your $170.10 Part B premium. You’ll receive all those extra benefits - and you may pay less for medical and drug costs!

If you think you might be eligible for this program or one that may possibly pay far more, we will help you apply but we’ll need your written authorization - Please capture this QR code:

BTW - What plan do you think worked well for Carl and Rosita? It was an HMO, and we’ll take a closer look at that after our next client.)

Client Tale #2

When client #2 Angela turned 65, she had become a Real Estate broker. Prior to retirement as an architect, she had designed and built a beautiful Padre Island home on the bay, and had a small yacht tied to her pier out back.

She could afford the most expensive Medicare plan available. What plan do you think she chose? Most people in my seminars tell me that she must have bought a supplement! But Angela chose an HMO Medicare Advantage plan. Here’s why: all her physicians and hospitals were in network, she would receive dental, vision and coverage for hearing aids. Also, she would pay no more premium at her fitness center, which would now be a part of the Silver Sneakers program. She did not mind needing a referral from her Primary Care Physician to see a specialist because she always did that anyway. She was excited that she did not have to pay the high monthly cost of a supplement. Do you see? There is no one size fits all!

What is a Medicare Advantage HMO?

An HMO is a Health Maintenance Organization which features care managed by a primary care physician who coordinates beneficiary care with specialists and puts a high priority on preventive care. People on HMO plans tend to have better health outcomes than those on other plans. Most HMO plans have $0 premium, the lowest copays, the richest benefits, and the most value-added services. So, why doesn’t everyone have an HMO? Some do not care for the required Primary Care Provider referral to see specialists. Compared to the PPO or Medicare Supplement, these plans also have smaller networks – and except for emergency room, urgent care, and travel plans with some HMOs, beneficiaries must stay within the network or insurance will not pay.

Client Tale #3

Client Tale #3 is Sally. She had an HMO when she first turned 65 and was very happy with it. She had no health issues and saw her doctor once a year for her annual physical, mammogram, pap smear and blood work.

Then she came down with Multiple Sclerosis and the specialists who were recommended to her were not in her HMO network. She didn’t have confidence in her new specialists. She started going to rehab 3 days a week at $480 per month. Her plan had a maximum out of pocket of $5,900, which she quickly used up from all the doctor and hospital visits and she worried as she saw her small savings account dwindle.

She now wanted a Medicare supplement but did not qualify because of her illness. What plan did she move to during Annual Enrollment to see the specialists that she really wanted to see?

Sally Moved to a PPO – a Preferred Provider Organization.

They have larger networks than HMO plans. No referral is required. They can be used out-of- network, although that may be at a higher cost. That means an increased risk of financial loss if highly utilized: Based on the current plans in Texas, their maximum Out-of-Pocket, could be more than $12,000 if out of network. They have less value-added benefits than HMO plans. But on a positive note, some plans have national networks; Like some HMO plans, certain PPOs will even put money back into your monthly Social Security checks to help toward your Part B premium.

Final Thoughts

Do you know which plan will work well for you? But what about a G Medigap Supplement? What about a High Deductible G Medigap Supplement? Most people – even many agents are not aware of this little gem. Again, there is “no one size fits all” – but which one is a perfect fit for you? Watch for the second podcast in our series to explore more Medicare plan options. Click on this link or capture this QR code to watch a 25-minute video that will explore these options in more detail:

This podcast is my original work and the pictures within are mine exclusively or I have purchased the right to use them.